This article by partner Ryan Rohlfsen and associate Daniel Flaherty was published by Law360 on March 1, 2018.

In March 2017, the U.S. Department of Justice extended the 2016 Foreign Corrupt Practices Act pilot program, pending a review of its “utility and efficacy.1 On Nov. 29, 2017, Deputy Attorney General Rod Rosenstein announced a revised FCPA corporate enforcement policy, which included three “enhancements” over the pilot program.2

This article evaluates the potential effect of the revised policy’s enhancements by charting their departure from the pilot program and analyzing how criminal resolutions during the pilot program might have come out under the revised policy.3 Although this article finds that the revised policy would have had no substantial effect on previous enforcement, it concludes that the revised policy makes the impact of self-disclosing possible FCPA issues to the DOJ slightly more predictable, but many questions remain.

A New Addition to the U.S. Attorney's Manual

The pilot program was announced April 5, 2016, ostensibly to enhance the DOJ’s ability to detect and prosecute violations of the FCPA.4 Under its terms, companies who self-disclosed potential violations could earn a discount of up to 50 percent off the bottom of the sentencing guidelines range, and were eligible for a discretionary declination.

In November 2017, one month after revealing a DOJ-wide working group was reviewing the pilot program, Rosenstein announced that the group concluded “there were opportunities for improvement.5 Accordingly, Rosenstein announced the revised policy.6

The revised policy, like the pilot program, seeks to “strike the balance in favor of greater clarity about [the DOJ] decision-making process.” But, unlike the temporary pilot program, it is incorporated indefinitely into the United States Attorney’s Manual § 9-47.120, which all U.S. federal prosecutors are directed to follow.7

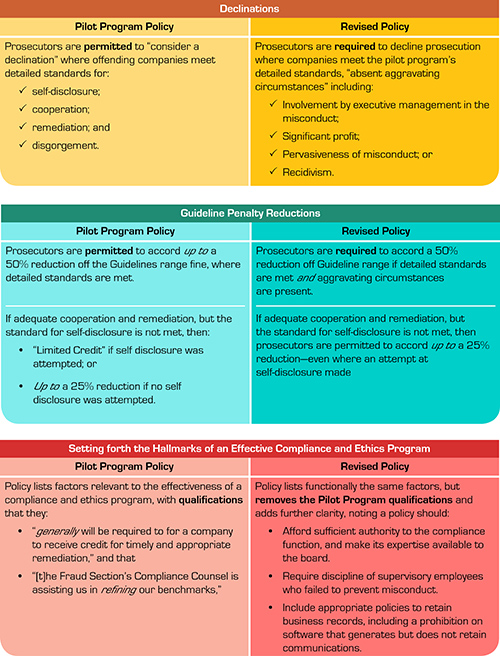

In addition, as summarized in the chart below, the revised policy contains three key departures from the pilot program, which Rosenstein called “enhancements.” First, the revised policy provides a path for companies to earn a “presumption that the Department will resolve the company’s case through a declination.” Second, it binds the DOJ to accord a 50 percent reduction where the criteria for a declination are met, but aggravating circumstances require a criminal resolution. Third, it sets out in greater detail “how the Department evaluates an appropriate compliance program” when determining whether a company remediated its issues.8

Comparing the Pilot Program to the Revised Policy

The Revised Policy Would Likely Not Have Affected Enforcement During the Pilot Program Period

Were the revised policy in effect since April 2016, outcomes would have been substantially the same.

From April 2016 through 2017, the DOJ resolved 22 FCPA cases — 15 criminal resolutions and seven formal declinations. Each of the 15 criminal resolutions featured the same “aggravating circumstance” — executive management of the company was involved in the misconduct. Thus the revised policy would not have permitted a declination in these matters either.

In the 15 criminal resolutions, only four companies attempted to self-disclose. One company — General Cable Corp — did so successfully, and received a 50 percent reduction.9 Given executive management’s involvement in the misconduct, the same outcome would have been reached under the revised policy. Two others, Analogic10 and SBM Offshore11 failed to meet the DOJ’s standard for self disclosure. The revised policy would have permitted up to a 25 percent reduction. SBM, which was resolved the day the revised policy was announced, received just that. Analogic received a 30 percent reduction, because the pilot program permitted “limited credit” or reductions greater than 25 percent but less than 50 percent where an attempt at self-disclosure was made. That could not happen now. Nonetheless, it appears the revised policy would have resulted in outcomes that were substantially the same for the four companies that attempted to self-disclose.

For the other 11 criminal resolutions, all but one received a reduction of either 20 percent or 25 percent. The one exception, LATAM Airlines Group, was required to pay 25 percent above the bottom of the guideline range — presumably because its CEO knowingly approved an improper payment.12 The revised policy, just like the pilot program, would have permitted up to a 25 percent reduction in each of these cases. Nothing in it would have lead to different outcomes.

Greater Clarity on the DOJ's Decision-Making Process Does Not Make a Company's Decision to Self-Disclose Clear

As detailed above, the revised policy slightly limits the DOJ’s discretion more than the pilot program in resolving certain matters. It also removes some of the uncertainty surrounding the DOJ’s remediation standard by more clearly committing to factors required for an effective compliance and ethics program, and describing them in greater detail. While the revised policy does provide more transparency about what companies can expect from the DOJ, questions remain.

Aggravating Circumstances Are Broadly Defined, But Some Patterns Have Emerged

Companies considering self-disclosure may be attracted to the promise of a presumption that a declination is appropriate. This presumption is rebutted whenever there are “aggravating circumstances.” The DOJ has provided a nonexhaustive list of examples, which may be difficult to evaluate in abstract.

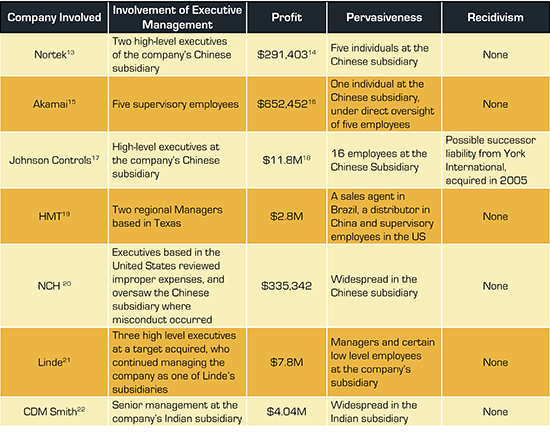

The seven pilot program declinations provide insight into how the DOJ might evaluate each aggravating circumstance, as detailed in the following table.13

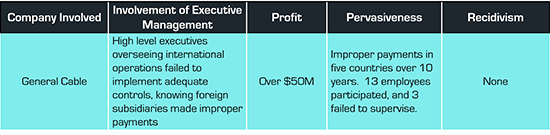

Compare these cases with the one company that the DOJ found adequately self-disclosed, cooperated, and remediated, but which received a criminal resolution instead of a declination.23

In aggregate, these eight cases provide key insight. While it may be difficult to distinguish management’s involvement at General Cable and NCH, it appears that involvement by regional managers or subsidiary executives generally does not rise to the level of a sufficiently aggravating circumstance. Similarly, if misconduct is isolated at a single subsidiary, and does not involve multiple countries, the DOJ might not deem the conduct sufficiently pervasive to be an aggravating circumstance. What counts as “significant profit” is difficult to determine, as it will depend upon the relative size of the company, profit margins, and other factors. Using the cases above, as high as $11.8 million was insufficient, while $50 million was enough. Of course, in any resolution, there are likely other issues and circumstances beyond these factors that may influence the ultimate result.

Self Disclosure Has More Certain Consequences, But Standards Still Must Develop Before Companies Can Count Credit With Any Certainty

The revised policy provides greater certainty about the consequences of incomplete self- disclosure. As discussed above, comparing SBM and Analogic shows that the revised policy has removed “limited credit” for inadequate self disclosure and now applies an all-or-nothing standard. Thus the revised policy eliminates uncertainty about credit that might be earned if a company tries, but fails, to meet the DOJ’s self-disclosure standard.

Nonetheless, the revised policy provides less guidance on the standard for self-disclosure than was available under the pilot program. For example, the revised policy no longer makes explicit that “[a] disclosure that a company is required to make, by law, agreement or contract, does not constitute voluntary self-disclosure.” Presumably, the DOJ will continue to evaluate self-disclosures in the same manner. But, it also might develop additional considerations. In Keppel Offshore, announced after the revised policy was announced, the DOJ did not credit the company for self-disclosing allegations regarding improper payments in Brazil because the DOJ was “already aware of the allegations” based on public reports.24 As the DOJ resolves more cases under the revised policy, the standard for self-disclosure should become clearer.

Remediation May Require Significant Changes In Electronic Record Retention

The revised policy, in one of the “enhancements” detailed above, provides greater detail on the compliance and ethics policies companies should adopt to receive remediation credit. Many of the details raise questions of degree, which may differ on the facts of each case. For example: the level of authority appropriate for the compliance function, the frequency with which its expertise should be made available to the board, and the extent to which supervisory employees should be disciplined.

One clear policy directive in the revised policy is that companies should “prohibit[] employees from using software that generates but does not appropriately retain business records or communication.” This statement is clearly a reaction to the emerging reality that employees increasingly use instant messaging and social network applications for business. Unlike corporate email accounts and file servers, these communications systems are difficult for companies to preserve and control. Imposing a system that would seek to eliminate such activities will be technically and practically challenging, particularly in light of bring-you-own-device policies and local privacy and data protection laws.

The Risk of Collateral Consequences Remains

Companies that choose to self disclose to the DOJ open themselves to legal and commercial risk not addressed by the revised policy. The revised policy only applies to the DOJ. But the U.S. Securities and Exchange Commission, other regulators, competitors, shareholders and corporate stakeholders might bring claims based on the information disclosed to the DOJ. The revised policy does not directly mitigate these potential collateral consequences.

As a primary consideration, given the nature of FCPA violations, companies should consider that they may receive a declination from the DOJ only to find themselves before other domestic or international enforcement bodies. Over the last two years there has been a noticeable increase in cross-border cooperation and enforcement. In fact, six of the 15 criminal resolutions since April 2016 have included parallel resolutions with foreign authorities. The revised policy does not prohibit the DOJ from providing self-disclosed information to other agencies.

Relatedly, self-disclosure to the DOJ has consequences in civil proceedings in the United States. For example, General Cable paid $55 million to the SEC after self-disclosing conduct.25 Following that resolution, the SEC brought proceedings against certain former General Cable executives. In those individual proceedings, General Cable was found to have waived work-product protection over notes and supporting memoranda its counsel had relied on while making an oral presentation to the SEC.26 As a result, General Cable had to provide those documents to its former executives. Similar circumstances in other cases could allow for the release of once-privileged material to civil litigants.

Conclusion

The revised policy may prove good on its promise to promote declinations and improve on the pilot program’s ability to prevent and detect FCPA violations. While it would not have substantially impacted pilot program enforcement decisions, the revised policy may further incentivize corporate self-disclosure by providing an incremental increase in transparency and predictability in the outcome of FCPA matters. However, many questions remain over how much the revised policy actually limits the DOJ in practice. In short, companies should consider these questions as part of the mix of factors impacting their exercise of business judgment in deciding whether to self disclose to the DOJ.

1 Acting Assistant Attorney General Kenneth A. Blanco Speaks at the American Bar Association National Institute on White Collar Crime (https://www.justice.gov/opa/speech/acting-assistant-attorney-general-kenneth-blanco-speaks-american-bar-association-national)

2 Deputy Attorney General Rosenstein Delivers Remarks at the 34th International Conference on the Foreign Corrupt Practices Act (https://www.justice.gov/opa/speech/deputy-attorney-general-rosenstein-delivers-remarks-34th-international-conference-foreign)

3 Many of the cases resolved in the Pilot Program’s first year arose prior to its announcement. Nonetheless, the DOJ appears to have applied the Pilot Program’s framework. See Evaluating FCPA Pilot Program: The Data, The Trends (https://www.law360.com/articles/912193/evaluating-fcpa-pilot-program-the-data-the-trends)

4 See Fraud Section’s Foreign Corrupt Practices Act Enforcement Plan and Guidance (https://www.justice.gov/criminal-fraud/file/838416/download)

5 Deputy Attorney General Rod Rosenstein Keynote Address on Corporate Enforcement Policy (https://wp.nyu.edu/compliance_enforcement/2017/10/06/nyu-program-on-corporate-compliance-enforcement-keynote-address-october-6-2017/).

6 Rosenstein Remarks, supra note 2

7 See USAM § 1-1.200

8 Please note that since the time the Pilot Program was announced, the DOJ has also issued non-binding Guidance cataloging a sample of questions it asks when evaluating Compliance Programs. Fraud Section’s Evaluation of Corporate Compliance Programs (https://www.justice.gov/criminal-fraud/page/file/937501/download); See also DOJ’s New Guidance for Compliance Programs (https://corpgov.law.harvard.edu/2017/03/19/dojs-new-guidance-for-compliance-programs/)

9 General Cable NPA (https://www.justice.gov/criminal-fraud/file/921801/download)

10 Analogic and BK Medical ApS NPA (https://www.justice.gov/opa/file/868771/download)

11 SBM Offshore DPA (https://www.justice.gov/criminal-fraud/file/1017346/download)

12 LATAM Airlines DPA (https://www.justice.gov/criminal-fraud/file/879136/download)

13 Nortek Declination (https://www.justice.gov/criminal-fraud/file/865406/download)

14 Nortek paid $291,403 in disgorgement, and $30,655 in prejudgment interest to the SEC. Nortek NPA (https://www.sec.gov/news/press/2016/2016-109-npa-nortek.pdf)

15 Akamai Declination (https://www.justice.gov/criminal-fraud/file/865411/download)

16 Akamai paid $652,452 in disgorgement, and $19,433 in prejudgment interest to the SEC. Akamai NPA (https://www.sec.gov/news/press/2016/2016-109-npa-akamai.pdf)

17 Johnson Controls Declination (https://www.justice.gov/criminal-fraud/file/874566/download)

18 Johnson Controls Cease and Desist Order (https://www.sec.gov/litigation/admin/2016/34-78287.pdf)

19 HMT Declination (https://www.justice.gov/criminal-fraud/file/899116/download)

20 NCH Declination (https://www.justice.gov/criminal-fraud/file/899121/download)

21 Linde Declination (https://www.justice.gov/criminal-fraud/file/974516/download)

22 CDM Smith Declination (https://www.justice.gov/criminal-fraud/page/file/976976/download)

23 General Cable NPA, supra note 9

24 Keppel Offshore DPA (https://www.justice.gov/opa/press-release/file/1020706/download)

25 General Cable Cease and Desist Order (https://www.sec.gov/litigation/admin/2016/34-79703.pdf)

26 See SEC v. Herrera, Case No. 1:17-cv-20301-JAL (S.D. Fla. Dec. 5, 2017).

Authors

Stay Up To Date with Ropes & Gray

Ropes & Gray attorneys provide timely analysis on legal developments, court decisions and changes in legislation and regulations.

Stay in the loop with all things Ropes & Gray, and find out more about our people, culture, initiatives and everything that’s happening.

We regularly notify our clients and contacts of significant legal developments, news, webinars and teleconferences that affect their industries.