With less than six months to go until the new prudential regime for UK MiFID firms is due to come into effect, the FCA has published its second policy statement.1 In this alert, we consider the impact on UK sub-advisory firms and AIFMs with MiFID top-up permissions.

Background and where are we now?

The FCA is implementing a new prudential regime for UK MiFID firms – the Investment Firm Prudential Regime (IFPR), which is due to come into effect on 1 January 2022. Key to the new regime is a requirement for firms to factor into their prudential assessments the risk the firm poses to consumers and to the markets (in contrast to risks posed to the firm alone). The FCA has already published two consultation papers setting out draft rules for the proposed regime, as well as draft reporting templates and guidance on completing these.

The first consultation paper as responded to by the FCA’s June policy statement2 covered the categorisation of investment firms, the scope of prudential consolidation and the group capital test, the types and treatment of own funds, concentration risk and reporting requirements. The June policy statement provided feedback to the responses received on these issues and includes a set of “near-final” rules.

The second consultation paper (published in April) as responded to by the FCA’s latest policy statement covered the draft rules on the methods of calculating own-funds requirements as well as the remuneration obligations. With varying levels of remuneration obligations for SNI firms, Non-SNI firms and large Non-SNI firms (see further details below on SNI classification). The second policy statement responds to the comments received on these issues and sets out in further detail the asset classes that can be used for meeting the basic liquid assets requirements as well as further detail on the remuneration obligations.

The final consultation paper, which is expected to be published shortly, will cover public disclosure requirements.

Who does the new regime apply to?

The new regime captures any UK MiFID investment firm authorised and regulated by the FCA, including firms that are currently subject to the BIPRU and GENPRU regimes, firms that are “full-scope”, “limited activity” and “limited licence”, as well as “exempt-CAD firms” among others. It will also apply to alternative investment fund managers (AIFMs) with MiFID top-up permissions (Collective Portfolio Management Investment firms or CPMIs).

The requirements will be set out in the new FCA sourcebook, MIFIDPRU.

|

CPMIs will need to apply the MIFIDPRU requirements and will also need to ensure they satisfy their existing prudential requirements. For US managers, with UK sub-advisers (currently exempt CAD firms), the new MIFIDPRU rules will apply. |

The implications for US parent companies of FCA-authorised firms is considered below - see Scope of FCA investment firm group for further details.

Categorisation of firms

Firms will fall into either the SNI firm category (Small and Non-Interconnected firms) or will be Non-SNI firms (i.e. all other investment firms). The current classifications of Exempt-CAD, BIPRU and IFPRU firms will cease.

SNI firms will be subject to a lighter-touch regime than Non-SNI firms. Whether a firm is an SNI or a Non-SNI will depend on its regulatory permissions (specifically firms that deal as principal cannot be SNIs) and certain quantitative thresholds in relation to the firm’s MiFID activities as set out in the table below.3 The thresholds are consistent with those recently implemented in the EU.

| Measure | Threshold |

| Assets under management (AUM) | <£1.2 billion |

| Client orders handled – cash trades | <£100 million per day |

| Client orders handled – derivative trades | <£1 billion per day |

| Assets safeguarded and administered | Zero |

| Client money held | Zero |

| Average daily trading flow – cash trades4 | Zero |

| Average daily trading flow – derivative trades | Zero |

| On- and off-balance sheet total | < £100 million |

| Total annual gross revenue from investment services and activities | <£30 million |

The calculation of AUM, client orders handled, the on- and off-balance sheet total and the total annual gross revenue for these purposes must be calculated on a combined basis and therefore should include the position of any of the following in the firm’s group: other MiFID investment firms, designated PRA investment firms, CPMIs and third-country investment firms to the extent they carry on investment services or activities in the UK. It should not therefore include a US parent company to a UK sub-advisor (assuming the US parent does not carry on business in the UK).

|

Importantly, for UK sub-advisors, the calculation of AUM also includes assets under ongoing advice. One of the key areas for UK sub-advisers to consider is whether their services fall within scope, and this will be a key aspect of how such firms implement the new rules. The FCA has clarified in its latest policy statement that ongoing advice must relate to the provision of MiFID investment advice (i.e. personal recommendations and not generic advice) and must either relate to (i) the recurring provision of investment advice or (ii) investment advice given in the context of the continuous or periodic assessment and monitoring or review of a client portfolio of financial instruments, including of the investment undertaken by the client on the basis of a contractual arrangement. Genuine “one-off” or sporadic investment advice is not included within the AUM calculation. The new guidance also clarifies that the AUM should be calculated by reference to the scope of the firm’s duty to advise in any given case (or in the case of recurring investment advice, the value of the financial instruments on which the firm advises). CPMIs should calculate the above measures (except in relation to the on- and off-balance sheet totals) in light of their MiFID business only to determine their SNI/Non-SNI classification. |

Whether a firm is classified as SNI or Non-SNI will have important implications for the application of the new requirements (with Non-SNIs required, for example, to consider a number of K-factors in their calculations as referred to below, as well as a requirement for all Non-SNIs to publicly disclose certain remuneration information – further details on this are to be published in the third consultation paper).

Capital Requirements – own funds

The own funds capital requirements depend on the firm’s classification (SNI or Non-SNI) and can be summarised as follows:

| SNI | Non-SNI | ||

| The higher of: | Fixed overheads requirement (FOR) | The higher of: | Fixed overheads requirement (FOR) |

| Permanent Minimum Requirement (PMR) | Permanent Minimum Requirement (PMR) | ||

| K-factor requirement – requires the calculation of a number of K-factors that broadly reflect the risks posed by the firm to clients and to the market and risks to firm itself. | |||

|

For CPMI firms, the FCA has confirmed that the FOR must capture the whole expenditure of the firm (not just its MiFID business) on both an individual basis and on a consolidated basis if it is part of an FCA investment group. The requirement to include FOR in the capital requirements calculation could have a significant impact on larger exempt-CAD firms. |

The Permanent Minimum Requirement (PMR) ensures there is a floor to the amount of own funds held. The amount of PMR depends on the activities undertaken by the firm. For firms that are not permitted to hold client money or assets and undertake portfolio management or provide investment advice, the PMR is £75,000.

|

For current exempt-CAD firms whose minimum capital requirement is €50,000, this will therefore increase to a minimum of £75,000. |

Risk management and governance – ICARA

The FCA is introducing a new internal capital and risk assessment (ICARA) process to replace the ICAAP. This will apply to all investment firms. Firms will need to look at the risks the firm poses to clients and the market and what additional own funds are needed to mitigate those risks. The FCA views the ICARA as central to a firm’s risk management process, and senior management should be involved throughout the process (and not just to sign it off). Through the ICARA process, firms should determine their additional own funds and liquid assets requirements in addition to the own funds requirements set out above. Firms must meet the “Overall Financial Adequacy Rule” (OFAR), i.e. a firm must hold adequate own funds and liquid assets to ensure it can remain viable throughout the economic cycle, i.e. it must be able to address potential harms from ongoing activities and be able to wind down in an orderly way.

Under the ICARA, firms will need to determine their “own funds threshold requirement” and “liquid assets threshold requirement” so as to meet the OFAR. A firm will be required to keep at least 110% of its own funds threshold requirement, and falling below that threshold will trigger a notification obligation to the FCA.

The FCA will use the results of the ICARA to determine which ICARAs it will review.

|

All firms including CMPIs and UK sub-advisors will need to carry out the ICARA process. |

Scope of FCA investment firm group

The FCA has clarified the scope of prudential consolidation and the group capital test apply to a “FCA investment firm group”, which consists of a UK parent and its subsidiaries (both UK and non-UK). Non-UK entities above the UK parent entity are not included. However, the FCA will have the power to apply individual requirements to specific group structures if it considers it desirable to advance its operational objectives. For example, if a group encompasses two FCA-regulated entities with a non-UK parent, a holding company could be deemed to be inserted so as to create a FCA investment firm group for prudential consolidation purposes.

|

A US parent company with two or more UK FCA-authorised subsidiaries may find it is required to deem a UK holding company to be inserted between the parent co and the subsidiaries so as to treat those subsidiaries as part of an FCA investment firm group. |

Remuneration Rules

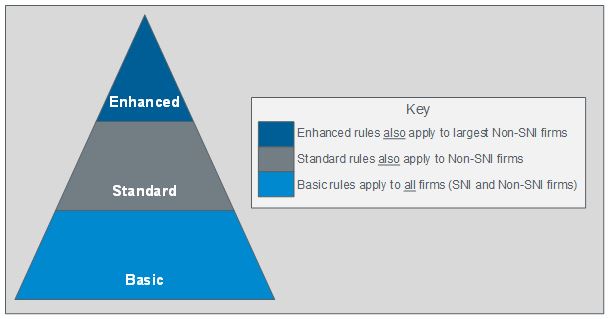

The new IFPR remuneration requirements will apply as follows:

All firms will be required to comply with the basic remuneration requirements. These include the following:

- remuneration policy to cover all staff. The principle of proportionality will still apply here so the policy should be proportionate to the firm’s size, internal organization and nature as well as the scope and complexity of the firm’s activities;

- management must adopt and periodically review the remuneration policy and should be responsible for overseeing its implementation and its compliance with the remuneration rules;

- policy must make a clear distinction between fixed and variable remuneration and should set the criteria on which the granting of any variable remuneration is based;

- any variable remuneration should not adversely affect the firm’s capital base.

|

CPMI firms will need to apply the relevant MIFIDPRU remuneration code requirements to their MIFID business and the AIFMD remuneration code to their AIFM business and where these cross over (due to an individual having responsibilities for both activities) – the stricter requirements should be applied. Current exempt-CAD firms will, for the first time, be required to comply with prescriptive remuneration requirements. |

Timeline

| December 2020 | First Consultation Paper published CP20/24 |

| April 2021 | Second Consultation Paper published CP21/7 |

| June 2021 | First Policy Statement 21/6 published – feedback to CP20/24 |

| July 2021 | Second Policy Statement 21/7 published – feedback to CP 21/7 |

| Early Q3 2021 | Third Consultation Paper expected |

| Early Q4 2021 | Third Policy Statement expected – feedback to Third Consultation Paper and Final Rules |

| 1 January 2022 | Implementation date |

Although the rules are not yet finalized, and we still await one further consultation paper and policy statement, the changes for some firms will be material and we recommend those who have not yet considered the impact of the new rules to start preparing. As mentioned above, current exempt-CAD firms for example, will see the imposition of more prescriptive remuneration rules and an increase in minimum capital requirements from €50,000 to at least £75,000 (subject to certain transitional provisions) and the imposition of the FOR, which could be significant for some UK advisors. CPMIs may want to consider whether their MIFID permissions are required and if not they may wish to consider varying their permissions to remove these prior to the implementation date.

If you would like any further information regarding the new capital regime please contact Eve Ellis for further details.

- https://www.fca.org.uk/publication/policy/ps21-9.pdf

- https://www.fca.org.uk/publication/policy/ps21-6.pdf

- The exception to this is the on- and off-balance sheet totals which are not limited to the firm’s MiFID activities.

- New measures introduced in the FCA’s second policy statement PS21/9 to cover firms that deal in their own name on an agency basis. (Firms that have permission to deal on own account cannot be SNIs, the new rules clarify that where a firm executes orders on behalf of a client in the firm’s own name (if this does not otherwise constitute dealing on own account), the average daily trading flow must be zero to be an SNI).

Authors

Stay Up To Date with Ropes & Gray

Ropes & Gray attorneys provide timely analysis on legal developments, court decisions and changes in legislation and regulations.

Stay in the loop with all things Ropes & Gray, and find out more about our people, culture, initiatives and everything that’s happening.

We regularly notify our clients and contacts of significant legal developments, news, webinars and teleconferences that affect their industries.