In recent weeks, opponents of the U.S. Department of Labor (DOL)’s so-called ESG rule have brought new challenges in the courts and in Congress. Most of the provisions of the DOL’s final rule addressing fiduciary duties for ERISA retirement plans with respect to investment selection and consideration of ESG factors as well as exercises of shareholder rights (the 2022 Rule), which the agency issued last fall (see our alert describing the rule here as well as our podcast offering additional commentary here), became effective as of January 30, 2023.

On January 26, 2023, attorneys general from 25 states, led by Ken Paxton of Texas and Sean Reyes of Utah, filed a lawsuit in the Northern District of Texas, attempting to prevent the 2022 Rule from taking effect and arguing that the 2022 Rule undermines key protections for retirement plan participants, oversteps the DOL’s authority under ERISA and is arbitrary and capricious in violation of the Administrative Procedure Act (APA). The complaint asks the court to set aside the 2022 Rule and enjoin the DOL from implementing or enforcing it in any manner. Following closely on the heels of this state-led lawsuit, on February 1, 2023, every Senate Republican, led by Sen. Mike Braun (R-IN), along with Sen. Joe Manchin (D-WV) and Rep. Andy Barr (R-KY), announced their plan to reintroduce legislation seeking to overturn the 2022 Rule under the Congressional Review Act, which would not be subject to filibuster. In the last session, Messrs. Braun and Barr introduced a joint resolution that did not pass, which sought to nullify the 2022 Rule shortly after it was finalized.

Given that the plaintiffs have filed their lawsuit in a forum that has displayed an antipathy toward many federal agency actions in recent years and the impending legislation to overrule the 2022 Rule, asset managers, plan sponsors and other fiduciaries may wish to monitor this litigation, while they at the same time remain mindful of the now-effective 2022 Rule. If Congress successfully deploys the Congressional Review Act, the DOL would be prohibited from engaging in further rulemaking substantially similar to the nullified rule; however, President Biden is widely expected to veto any such action. The remainder of this alert focuses on the litigation brought by the state attorneys general.

Who Are the Plaintiffs?

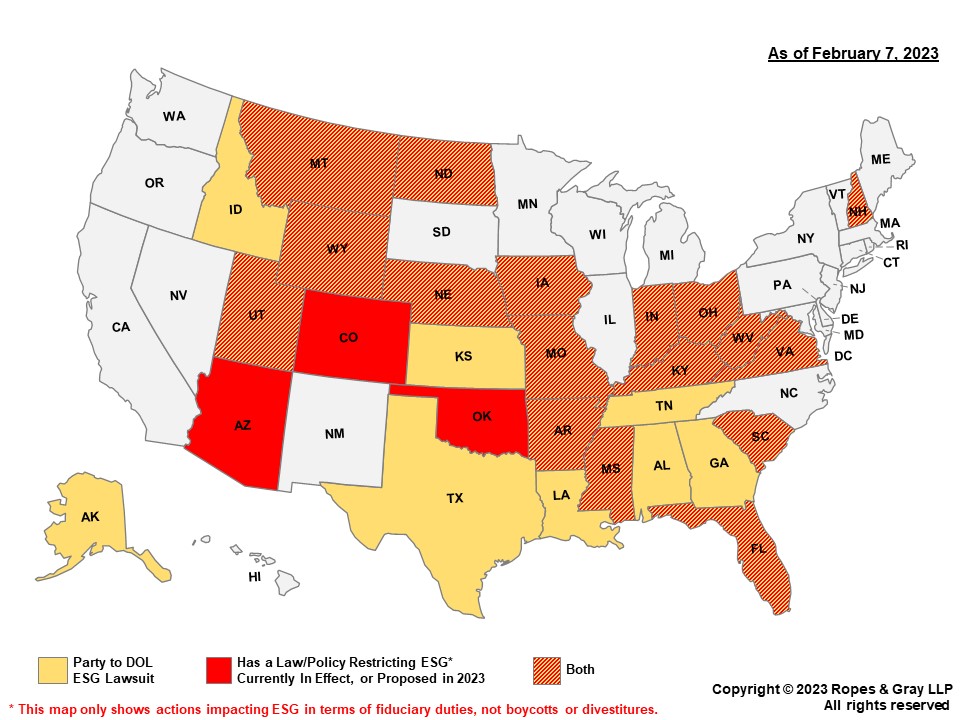

The plaintiffs include a coalition of states (collectively, the State Plaintiffs) led by Republican elected officials, many of which have taken action via new legislation, regulations, executive pronouncements and enforcement actions to curb the role of ESG investments in public sector retirement systems. These actions have taken different tacks, from explicitly restricting the use of ESG considerations in public plan investments (limiting decision-making to consideration of pecuniary factors), to divesting public funds from asset managers and other financial institutions that have made statements in support of ESG, joined climate-related initiatives, and/or allegedly “boycotted” the fossil fuel or firearms sectors.

While ERISA does not apply to governmental plans, the State Plaintiffs assert Article III standing to challenge the DOL regulation on the basis that the 2022 Rule harms their proprietary and parens patriae interests in the form of diminished tax revenues and the economic well-being of their residents. For example, the complaint asserts how some of the State Plaintiffs have significant oil and gas deposits, and fossil fuel companies have a substantial presence in those states for the purpose of oil and gas exploration and extraction. The State Plaintiffs allege that the 2022 Rule will lead to reduced investment in the fossil fuel industry, which, in turn, will reduce the revenue that accrues to the states through oil and gas extraction, negatively impact employment, and decrease overall economic activity and tax revenue in these states.

There are also three private plaintiffs that joined the complaint, which include: (i) Liberty Energy, Inc., a publicly traded energy company whose subsidiary, Liberty Oilfield Services LLC, sponsors a 401(k) plan for its employees and is a fiduciary and trustee under ERISA, (ii) Western Energy Alliance, a trade association representing oil and natural gas companies across the western United States, and (iii) James Copland, an individual participant in an ERISA retirement plan (collectively, the Private Plaintiffs). The Private Plaintiffs assert standing to sue on the basis that the 2022 Rule will cause them to lose what they describe as the protections put in place by the prior investment selection regulation (2020 ESG Rule) as well as the proxy voting regulation (2020 Proxy Rule) that the Trump administration adopted, both of which the 2022 Rule superseded. The Private Plaintiffs claim the 2022 Rule will force them to expend additional time and resources monitoring and reviewing recommendations from investment advisers, without the “benefit of recordkeeping requirements or clearer fiduciary duty regulations, to ensure they are focusing explicitly on pecuniary considerations and not collateral ESG factors.” Additionally, as a publicly traded company, Liberty Energy claims the 2022 Rule will lead to decreased interest from investors and access to investment capital. If these Private Plaintiffs have standing, then any question whether the states also have standing may be immaterial.

What Are the Arguments?

In summary, the complaint alleges that the 2022 Rule injects collateral, nonfinancial ESG factors into the investment and shareholder proxy voting decisions of plan fiduciaries in a manner that is supported by neither ERISA nor legal precedent. Moreover, it claims the 2022 Rule fails under the major questions doctrine that was addressed in West Virginia v. EPA, 142 S. Ct. 2587, 2609 (2022), since it is a rule of such “vast economic and political significance” that it requires clear authorization from Congress. Lastly, the plaintiffs claim that the 2022 Rule should be set aside because it constitutes an arbitrary and capricious exercise of administrative power in violation of the APA. These arguments are briefly summarized below.

- 2022 Rule Conflicts with ERISA – The complaint asserts that ERISA’s exclusive purpose requirements (i.e., to invest plan assets in the interest of participants and beneficiaries and for the exclusive purpose of providing benefits and paying plan expenses) obligate fiduciaries to consider “financial benefits” and not “any nonpecuniary benefits.” To support this proposition, the complaint cites various case law, including Fifth Third Bancorp v. Dudenhoeffer, 573 U.S. 409, 420 (2014), (which used the terminology pecuniary and nonpecuniary) as well as principles from the common law of trusts, on which ERISA was largely based. Separately, the complaint argues that the 2022 Rule allows fiduciaries to have “substantial wiggle room…to consider collateral benefits in investments through the application of the ‘tiebreaker standard’—in direct contradiction to ERISA’s statutory commands—in a much broader class of cases.”

- 2022 Rule Fails under the “Major Questions” Doctrine – Joining a recent trend in challenges to agency action, the complaint invokes the major questions doctrine, arguing that the DOL’s statutory authority to regulate in this area has a much narrower scope than what it has done in its 2022 Rule. Additionally, it argues that courts should hesitate before finding that the DOL has authority to regulate in this area for “nonfinancial” purposes, in light of the magnitude of the assets that the 2022 Rule would affect. The complaint also mentions how the U.S. Supreme Court recently rejected attempts to locate newfound powers in longstanding grants of regulatory authority to address novel issues such as climate change in West Virginia v. EPA, and that “the DOL is thus claiming the authority to do what the EPA cannot…to pursue the current administration’s preferred climate objectives.”

-

2022 Rule Is Arbitrary and Capricious in Violation of the APA – The complaint makes multiple allegations for why the 2022 Rule amounts to an arbitrary and capricious exercise of administrative power in violation of the APA, including:

-

Relevant Considerations Were Ignored – According to the complaint, the 2022 Rule ignored considerations relevant to ERISA, including past findings the DOL made with respect to the 2020 ESG and Proxy Voting Rules, and instead relied on factors that Congress did not intend for the DOL to consider. In particular, it notes how the 2020 ESG Rule offered factual findings regarding the “shortcomings in the rigor of the prudence and loyalty analysis by some participating in the ESG marketplace,” and that stricter regulations were needed to protect investors and ensure compliance with ERISA. The complaint states that the 2022 Rule does not address this factual finding, nor does it dispute that the 2020 ESG and Proxy Voting Rules protect investors and are effective in stopping fiduciary violations.

- Lack of Justification for Replacing the 2020 Rules – The complaint also claims that the DOL’s justifications for revoking the 2020 ESG and Proxy Rules and adopting the 2022 Rule were insufficient, because the agency did not explain the chilling effect or confusion that the 2020 rules supposedly engendered, nor did it identify any “reduction in the financial returns for plan participants.”

- Rationale for Eliminating the Stickering and Documentation Requirements of the Tiebreaker Standard Is Inadequate – In its discussion of the tiebreaker standard, the complaint alleges that the DOL’s reasoning for eliminating the collateral-benefit disclosure and other documentation requirements was not adequate. It claims that there was no evidence that additional documentation requirements such as the stickering provision in the DOL’s 2021 re-proposal, or the more detailed documentation requirements included in the 2020 ESG Rule, would unduly burden fiduciaries and increase transaction costs, and that the removal of these requirements will inhibit participants from monitoring the activities of fiduciaries.

- Failure to Propose Sub-Regulatory Guidance Clarifying the 2020 Rules – According to the complaint, instead of rescinding the 2020 ESG and Proxy Voting Rules and adopting a new regulation, the DOL should have returned to its longtime practice of relying upon sub-regulatory guidance to clarify any uncertainties regarding a fiduciary’s duty of prudence in relation to collateral factors. As the complaint notes, this would have avoided formally injecting ESG and climate-change concepts into the regulatory text.

- 2022 Rule Is a Result of the DOL’s “Unlawful Prejudgment” – Finally, the complaint claims the 2022 Rule is arbitrary and capricious because the “DOL decided what to do before it reviewed the public comments.” It states how the DOL sought “to determine how to craft rules that better recognize the role that ESG integration can play in the evaluation and management of plan investments in ways that further fundamental fiduciary obligations.” In particular, it asserts that “[t]o determine how, rather than whether, is an admission that a new rule was coming no matter how thoroughly the comments refuted the need for one.” Moreover, the complaint provides that while the 2022 Rule identifies differences between the final and proposed rules, none of these changes goes to the “fundamental question of whether to rescind the 2020 rules and replace them with a rule more favorable to ESG investing.”

-

Initial Reactions and Takeaways

This lawsuit is seeking to reverse a rule that has received nearly universal recognition from interested parties for striking a fair and balanced approach to ERISA retirement plan investing and proxy voting. Despite the plaintiffs’ allegations, the DOL was clear in the preamble as well as in the operative text that the regulation is neutral on what financial factors, including ESG factors, a plan fiduciary may consider, and that there is no mandate to consider the economic effects of climate change or other ESG factors when evaluating and selecting ERISA plan investments. According to the DOL, ESG factors should be treated no differently from any other relevant investment factors. In other words, in some cases, climate change and other ESG factors may be relevant to a risk-and-return analysis, and in other cases, they will not be—and when they are relevant, these factors may be weighted and factored into investment decisions alongside other relevant factors, as the plan fiduciary has deemed appropriate.

Separately, while the complaint proffers various arguments for why the 2022 Rule could be viewed as arbitrary and capricious, it fails to discuss the significant differences between the notice-and-comment process for the 2020 ESG and Proxy Rules and the 2022 Rule. As compared to the 2022 Rule, the 2020 ESG and Proxy Rules had shorter comment periods, garnered more individual written comment letters, and were finalized after shorter amounts of time following the end of their respective comment periods.

|

2020 ESG Rule |

2020 Proxy Rule |

2022 Rule |

|

|

Comment Period |

30 Days |

30 Days |

60 Days |

|

# of Individual Written Comments Received |

1,100 |

300 |

895 |

|

Days Lapsed between Comment Period End and Final Rule Publication |

106 Days |

72 Days |

353 Days |

Moreover, in contrast to the 2020 ESG and Proxy Voting Rules, the overwhelming majority of the written comments that the 2022 Rule received were in favor of what the DOL had proposed. Those comments reflected the views of a wide array of stakeholders, from asset managers, plan sponsors and industry trade associations to retiree and participant advocacy groups, representing a broader array of voices and interests than the plaintiff group.

Finally, from the State Plaintiffs’ perspective, this lawsuit could be seen as an opportunity to validate the various state interpretations of fiduciary duties for investing public retirement plan money. In many states, the applicable laws governing public retirement plan oversight and investments incorporate, nearly verbatim, the statutory language of ERISA. Over the last few years, a number of states have proposed (or have already enacted) legislation as well as issued executive orders and attorney general opinions that narrowly construe fiduciary duties with respect to investing public pension assets. In particular, they explicitly incorporate “pecuniary factor” concepts and terminology along the lines of the 2020 ESG and Proxy Rules, and they typically include express prohibitions on the consideration of ESG and other “collateral” factors when making public pension investment decisions. Therefore, a decision that rescinds the 2022 Rule and revives the 2020 Rules (or at least some version of them) would give credence to these state law interpretations.

Although the Article III standing analysis as well as the merits of this complaint may seem questionable at first glance, the fact that the plaintiffs filed this suit in the Northern District of Texas is significant. The district court is in the Fifth Circuit, which in 2018, vacated the DOL’s investment advice fiduciary rule and related exemptions that were promulgated under the Obama administration. Moreover, Judge Matthew J. Kacsmaryk, a Trump appointee who has been assigned to the case, has been responsible for reversing several other agency actions approved by the Biden administration in recent months, including, an attempt by the U.S. Department of Health and Human Services to bar family planning providers from telling parents about their children requesting birth control (Deanda v. Becerra, N.D. Tex., No. 20-cv-92, judgment entered December 20, 2022), as well as the U.S. Equal Employment Opportunity Commission’s guidance allowing exceptions for LGBT employees from workplace policies on bathrooms, dress codes and locker rooms (State of Texas v. EEOC, N.D. Tex., No. 21-00194, October 1, 2022). On February 7, 2023, the DOL filed a motion seeking to transfer the case to another venue, asserting that the “[p]laintiffs’ decision to forum shop by filing in the Northern District—and, in particular, in the single-judge Amarillo Division, which has no connection whatsoever to this dispute—undermines public confidence in the administration of justice.”

With the 2022 Rule now largely in effect, many plan sponsors, asset managers and other fiduciaries have begun evaluating their processes for investment decision-making and proxy voting, and deciding whether certain procedural or documentary changes are warranted. This lawsuit, as well as the latest effort to veto the rule under the Congressional Review Act serve as important reminders of the need to monitor the broader legal landscape surrounding the 2022 Rule, and whether it ultimately survives.

Ropes & Gray is proud to have launched an award-winning interactive website, Navigating State Regulation of ESG Investments, offering resources for monitoring the rapidly evolving legal and regulatory landscape concerning what role, if any, ESG factors should play in managing public retirement plan assets and other related developments. To receive future, periodic updates, please be sure to sign up for our dedicated state ESG mailing list on this website.

About Our Practice

Ropes & Gray has a leading ESG, CSR and business and human rights compliance practice. We offer clients a comprehensive approach in these subject areas through a global team with members in the United States, Europe and Asia. Senior members of the practice have advised on these matters for more than 30 years, enabling us to provide a long-term perspective and depth and breadth of experience that few firms can match.

For further information on the practice, click here.

Authors

Stay Up To Date with Ropes & Gray

Ropes & Gray attorneys provide timely analysis on legal developments, court decisions and changes in legislation and regulations.

Stay in the loop with all things Ropes & Gray, and find out more about our people, culture, initiatives and everything that’s happening.

We regularly notify our clients and contacts of significant legal developments, news, webinars and teleconferences that affect their industries.