In Dealmaker’s Digest, read the top 10 latest developments in global transactions. We offer insights into M&A activity across industries and borders. To receive our M&A thought leadership, please join our mailing list.

Key Takeaways from October

- Global transactional activity: October saw a general decline in global transactional activity. This is consistent with historical market slowdowns ahead of U.S. presidential elections, given the potential for broad shifts in economic, fiscal and foreign policies.

- Cross-border deals: U.S. cross-border transaction activity remains high, with many October deal values and counts peaking for 2024.

- Election implications for 2025: The overall economic outlook for next year remains strong. Initial market reactions to the U.S. presidential election have shown optimism for business-friendly policies under the Trump administration, including tax cuts and less aggressive regulatory policies.

Global M&A Activity Update

1. Deal Value Trends

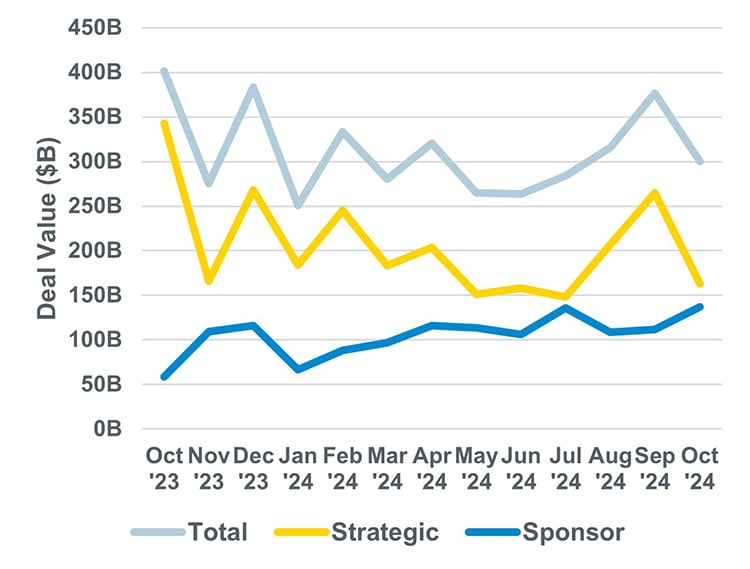

![]() Aggregate global monthly deal value1 in October decreased 20% from September and was down 25% year-over-year (vs. October 2023). The decline in transactional activity was consistent with historical market slowdowns ahead of U.S. presidential elections, given the potential for broad shifts in economic, fiscal and foreign policies.

Aggregate global monthly deal value1 in October decreased 20% from September and was down 25% year-over-year (vs. October 2023). The decline in transactional activity was consistent with historical market slowdowns ahead of U.S. presidential elections, given the potential for broad shifts in economic, fiscal and foreign policies.

![]() Transactions involving strategic buyers in October dropped 39% by value from September, down by over $100 billion. Strategic deal value in October decreased 52% year-over-year (vs. October 2023).

Transactions involving strategic buyers in October dropped 39% by value from September, down by over $100 billion. Strategic deal value in October decreased 52% year-over-year (vs. October 2023).

![]() Financial, or sponsor, buyer transactions increased 22% in October. Year-over-year (vs. October 2023), sponsor buyer deal value skyrocketed 135%.

Financial, or sponsor, buyer transactions increased 22% in October. Year-over-year (vs. October 2023), sponsor buyer deal value skyrocketed 135%.

2. Deal Count Trends

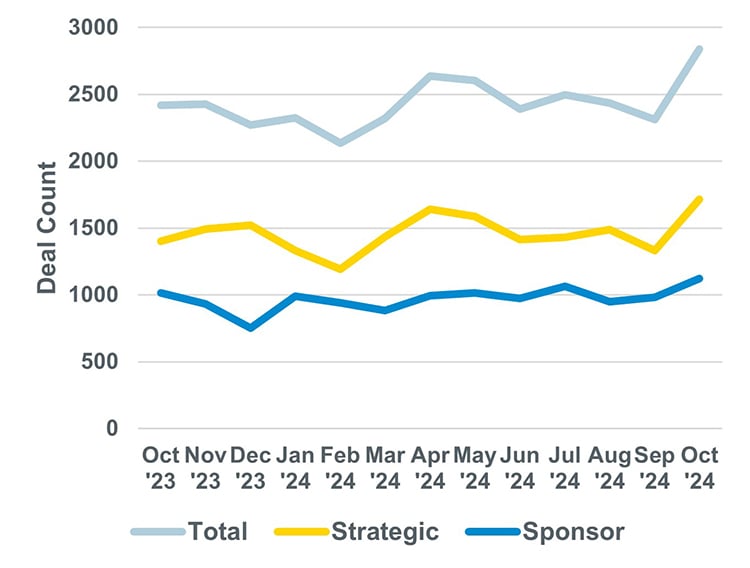

![]() Global deal count increased 23% in October from September, driven by smaller-dollar transactions that are less impacted by regulatory or geopolitical headwinds. Deal count was also up 18% year-over-year (vs. October 2023).

Global deal count increased 23% in October from September, driven by smaller-dollar transactions that are less impacted by regulatory or geopolitical headwinds. Deal count was also up 18% year-over-year (vs. October 2023).

![]() Strategic buyer deal count in October also rose, increasing 29% from September. Strategic deal count was up 22% year-over-year (vs. October 2023).

Strategic buyer deal count in October also rose, increasing 29% from September. Strategic deal count was up 22% year-over-year (vs. October 2023).

![]() Sponsor buyer deal count in October increased 14% from September and was up 11% year-over-year (vs. October 2023).

Sponsor buyer deal count in October increased 14% from September and was up 11% year-over-year (vs. October 2023).

Crossborder Corner

7. Inbound U.S. M&A Activity

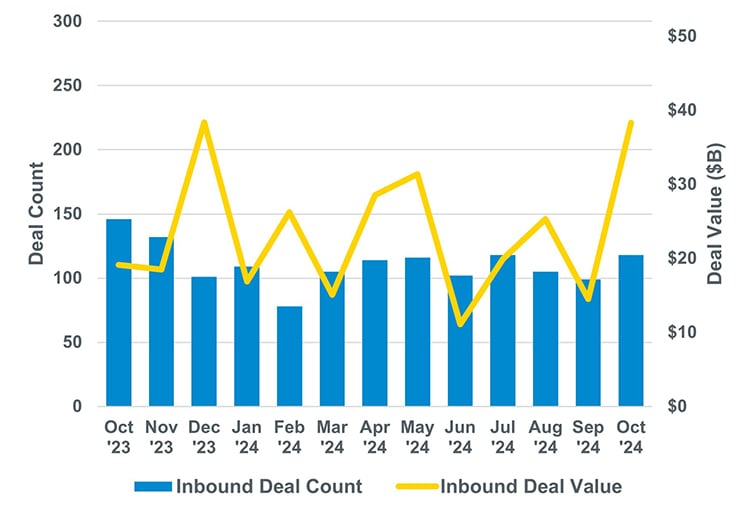

- By deal value, inbound U.S. activity increased in October, more than doubling from September. Year-over-year (vs. October 2023) inbound deal value increased 50%.

- By deal count, acquisitions of U.S. targets by non-U.S. acquirers increased 19% in October vs. September. Year-over-year (vs. October 2023), inbound deal count decreased 24%.

- UK-based acquirers undertook the largest number of inbound transactions in October (with 24 deals), followed by Canada and Japan (each with 16 deals).

8. Outbound U.S. M&A Activity

- By deal value, outbound activity declined, dropping 15% from September to October, and down 5% year-over-year (vs. October 2023).

- By deal count, acquisitions of ex-U.S. targets by U.S. buyers increased 29% from September to October. However, year-over-year (vs. October 2023) outbound count fell 15%.

- U.S. acquirers most frequently looked to targets in the UK during October (with 52 transactions), followed by Canada (with 31 transactions). Germany and France each had 12 U.S.-driven transactions.

Post-Election Takeaways

9. Economic and M&A Outlook

- With the 2024 U.S. presidential election behind us, one set of uncertainties has been traded for another; several directional shifts are already being observed, and others appear likely based on political trends.

- The overall economic outlook for 2025 remains strong; the U.S. has sustained economic growth in the face of ongoing geopolitical conflicts and inflation following the pandemic. Initial market reactions to the U.S. presidential election have shown optimism for business-friendly policies under the Trump administration, including tax cuts and less aggressive regulatory policies.

- Despite the optimistic outlook, it is impossible to predict market responses to escalations of existing conflicts or emergent turbulence. Even seemingly minor developments, such as supply chain disruptions or political miscalculations, could snowball into a broader market correction.

- Several bright spots for dealmakers appear likely in the near term:

- Adjustment of antitrust enforcement policies, which have been aggressive under FTC chair Lina Kahn, is expected to facilitate high-profile and large-dollar transactions, many of which have been stymied under the Biden administration.

- Cross-border M&A is expected to remain a critical strategy for growth, innovation, and corporate returns, and will likely be a key driver of the M&A landscape in 2025.

- Key sectors to watch over the next year include the tech industry, based on promises to deregulate broadly and accelerate innovation, and the energy sector, poised to continue its recent momentum considering the Trump campaign’s rhetoric on fossil fuels.

10. SEC Regulation & Enforcement

- The upcoming administration change is already sparking changes at the SEC; chair Gary Gensler recently announced his plan to step down on January 20, 2025, paving the way for the Trump administration to select a replacement in the near term. In the interim, the Commission will be led by an acting chair who is expected to be either Mark Uyeda or Hester Peirce, both Republican commissioners.

- Under the Biden administration, Gensler and the SEC pursued an aggressive agenda on several hot-button issues, including climate-risk disclosures, stock-trading revamps and a hostile posture toward cryptocurrency broadly, which led to accusations by states (and others) of regulatory overreach.

- Regulatory priorities under a Trump-selected SEC chair will likely differ significantly from those under Gensler’s helm on several of these issues. Trump frequently made campaign stops at crypto-focused events and has positioned himself as a cryptocurrency advocate; it has been reported that he is even considering a new White House crypto role. Similarly, new climate disclosure rules are unlikely to survive under the incoming Republican-led Commission.

- With respect to the asset management industry, the SEC’s Division of Investment may see less immediate turnover in leadership. However, the appointment of a new SEC Chair is expected to shift the regulatory focus of the Division towards a more deregulatory approach (consistent with Trump’s first term), potentially removing certain rulemaking items related to ESG disclosures, private market reforms, and security-based swap reporting from the SEC’s agenda.

- Enforcement priorities are also expected to shift, with a new Director of the Division of Enforcement likely to adopt less aggressive stances on penalties and novel legal theories, focusing instead on more traditional violations of SEC rules.

- For more information on potential SEC developments and implications for asset managers, read our full alert.

- Unless otherwise noted, charts compiled using Mergermarket data for October 2024 as of November 5, 2024. Aggregate deal values by dollar amount are calculated from the subset of deals with disclosed values.

- Medical industry classification principally includes medical devices/technology/services, excluding biotech and pharmaceutical deals.

Stay Up To Date with Ropes & Gray

Ropes & Gray attorneys provide timely analysis on legal developments, court decisions and changes in legislation and regulations.

Stay in the loop with all things Ropes & Gray, and find out more about our people, culture, initiatives and everything that’s happening.

We regularly notify our clients and contacts of significant legal developments, news, webinars and teleconferences that affect their industries.