In Dealmaker’s Digest, read the top 10 latest developments in global transactions. We offer insights into M&A activity across industries and borders. To receive our M&A thought leadership, please join our mailing list.

Key Takeaways

- Global M&A value in April declined from March, as megadeal activity tapered off and uncertainty over economic policies continued.

- Global deal count, meanwhile, ticked up month-over-month, driven by corporate and sponsor middle market acquisitions in April.

- Acquisitions in the software and financial services sectors led U.S. M&A activity in April by deal value and count, which followed similar trends in March.

Global M&A Activity Update

Deal Value Trends

Deal Value Trends

![]() Aggregate global monthly deal value1 in April dropped 36% (about $150 billion) from March’s megadeal-fueled surge.2 Total deal value was down 14% year-over-year.

Aggregate global monthly deal value1 in April dropped 36% (about $150 billion) from March’s megadeal-fueled surge.2 Total deal value was down 14% year-over-year.

Transactions involving strategic buyers fell 42% by deal value from March and 27% year-over-year.

Transactions involving strategic buyers fell 42% by deal value from March and 27% year-over-year.

![]() Financial, or sponsor, buyer transactions declined 29% by value from March (which marked a multi-year high for monthly sponsor deal value). Despite the significant month-over-month decline, sponsor deal value increased 10% year-over-year.

Financial, or sponsor, buyer transactions declined 29% by value from March (which marked a multi-year high for monthly sponsor deal value). Despite the significant month-over-month decline, sponsor deal value increased 10% year-over-year.

Deal Count Trends

Deal Count Trends

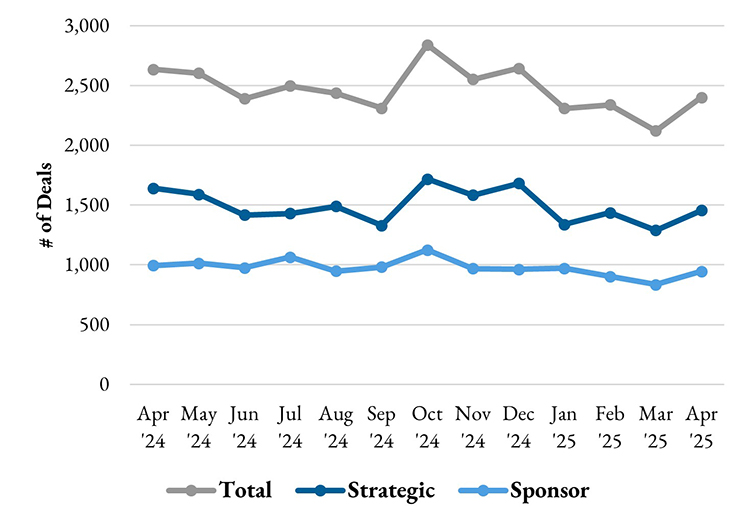

![]() Global deal count in April increased 13% month-over-month but declined 9% year-over-year.

Global deal count in April increased 13% month-over-month but declined 9% year-over-year.

![]() Strategic buyer deal count in April increased 13% from March. Year-over-year strategic deal count fell 11%.

Strategic buyer deal count in April increased 13% from March. Year-over-year strategic deal count fell 11%.

![]() Following the broader deal count trends, sponsor activity increased moderately (13%) month-over-month but declined 5% year-over-year.

Following the broader deal count trends, sponsor activity increased moderately (13%) month-over-month but declined 5% year-over-year.

Active M&A Industries (U.S. Targets)

By Deal Count

By Deal Count

- The software industry remained at the top for U.S. M&A activity by deal count in April, continuing its streak as the leading industry by volume, with nearly twice as many deals as the runner-up.

- Services industries remained active, with financial services and other professional services rounding out the top three sectors in April by deal count.

By Deal Value

By Deal Value

- The software industry also topped the charts by deal value; three of the six largest U.S. deals in April involved a target in the software sector.

- The financial services and energy sectors trailed in second and third, respectively, for most active sectors by deal value in April.

Monthly Blockbuster Deals

Largest U.S. Strategic Deal

Largest U.S. Strategic Deal

Global Payments Inc. has agreed to acquire WorldPay for a mix of cash and stock valued at $24.25 billion.4

Largest U.S. Sponsor Deal

Largest U.S. Sponsor Deal

Boeing has agreed to sell portions of its Digital Aviation Solutions business to Thoma Bravo in an all-cash transaction valued at approximately $10.55 billion.

Inbound U.S. M&A Activity

Inbound U.S. M&A Activity

- By deal value, inbound U.S. activity rose 20% in April to nearly $50 billion, bolstered by substantial acquisitions in the financial services, energy and technology sectors. Year-over-year, inbound deal value increased 72%.

- By deal count, acquisitions of U.S. targets by non-U.S. acquirers declined 16% in April, which marked a 14-month low. Year-over-year, inbound deal count declined 28%.

- UK-based acquirers undertook the largest number of inbound transactions in April with 12 deals, followed by Canada with 11 deals and Germany with eight.

Outbound U.S. M&A Activity

Outbound U.S. M&A Activity

- By deal value, outbound activity in April declined 54% from March and fell 31% year-over-year.

- By deal count, acquisitions of ex-U.S. targets by U.S. buyers held steady from March to April (+1%). Year-over-year, outbound deal count fell 15%.

- U.S. acquirers predominantly looked to targets in the UK in April, with 37 transactions. Canada took second place with 14 transactions, while Germany and India tied for third with 10 deals each.

Shareholder Activism Trends

Shareholder Activism Trends

- Activist campaigns seeking board representation declined globally in 2024, down 8% from 2023’s four-year high, but outpaced annual launches in 2020, 2021 and 2022.

- In 2024, 43 % of activist attempts to gain board representation were successful. Of the successful campaigns, nearly half (48%) of board seat wins resulted from a proxy fight.

- More than 120 campaigns seeking board seats have been launched in 2025 YTD, which outpaces recent pro rata trends.

Delaware Court of Chancery Update: Desktop Metal, Inc. v. Nano Dimensional Ltd.

Delaware Court of Chancery Update: Desktop Metal, Inc. v. Nano Dimensional Ltd.

- In a merger dispute between a reluctant buyer and a financially distressed target, Delaware’s Court of Chancery recently ordered6 specific performance of the parties’ merger agreement and compelled the buyer to enter into a national security agreement with CFIUS and to close the transaction.

- The agreement included a “hell or high water” (HOHW) clause requiring the buyer to take all actions necessary to obtain CFIUS approval, which was the last remaining contractual impediment to closing. The buyer had also agreed to use reasonable best efforts to close as soon as reasonably possible.

- Between signing and closing, a significant stockholder of the buyer—who opposed the deal—launched a proxy contest, gained control of the board and slow-rolled the CFIUS approval process.

- The court determined that the buyer breached its obligations under the HOHW provision, as well its obligation to use reasonable best efforts to timely close.

- The decision illustrates the importance, and successful enforcement, of agreement provisions that are frequently negotiated to ensure deal certainty and speed.

- Unless otherwise noted, charts compiled using Mergermarket data for April 2025 as of May 5, 2025. Aggregate deal values by dollar amount are calculated from the subset of deals with disclosed values.

- Aggregate deal value spiked 62% in March, driven by a wave of large-cap acquisitions including Google’s $32 billion acquisition of Wiz and Sycamore Partners’ $24 billion takeover of Walgreens.

- Medical industry classification principally includes medical devices/technology/services, excluding biotech and pharmaceutical deals.

- Global Payments concurrently entered into an agreement to divest its Issuer Solutions business to Fidelity Investment Services for $13.5 billion.

- Charts compiled using FactSet data as of May 13, 2025.

- Desktop Metal, Inc. v. Nano Dimension Ltd., C.A. No. 2024-1303-KSJM (Del. Ch. Mar. 24, 2025)

Stay Up To Date with Ropes & Gray

Ropes & Gray attorneys provide timely analysis on legal developments, court decisions and changes in legislation and regulations.

Stay in the loop with all things Ropes & Gray, and find out more about our people, culture, initiatives and everything that’s happening.

We regularly notify our clients and contacts of significant legal developments, news, webinars and teleconferences that affect their industries.