In Dealmaker’s Digest, read the top 10 latest developments in global transactions. We offer insights into M&A activity across industries and borders. To receive our M&A thought leadership, please join our mailing list.

Key Takeaways

- Global M&A activity was mixed in May: aggregate deal value jumped nearly 40% month-over-month, while total deal count declined 8%.

- U.S. crossborder activity was also mixed, with inbound acquisitions falling sharply and outbound activity increasing by value.

- Acquisitions in the software and telecom sectors led U.S. M&A activity in May.

Global M&A Activity Update

Deal Value Trends

Deal Value Trends

![]() Aggregate global monthly deal value1 in May rose 38% (about $100 billion) from April, the second-highest monthly value seen in over a year. Total deal value was up 43% year-over-year.

Aggregate global monthly deal value1 in May rose 38% (about $100 billion) from April, the second-highest monthly value seen in over a year. Total deal value was up 43% year-over-year.

![]() Transactions involving strategic buyers in May jumped 61% by deal value from April, up 58% year-over-year.

Transactions involving strategic buyers in May jumped 61% by deal value from April, up 58% year-over-year.

![]() Financial, or sponsor, buyer transactions moderately increased as well, up 11% by value from April and 24% year-over-year.

Financial, or sponsor, buyer transactions moderately increased as well, up 11% by value from April and 24% year-over-year.

Deal Count Trends

Deal Count Trends

![]() Global deal count in May declined 8% month-over-month and 15% year-over-year.

Global deal count in May declined 8% month-over-month and 15% year-over-year.

Strategic buyer deal count in May decreased 13% from April to the lowest count recorded in over a year. Strategic deal count fell 20% year-over-year.

Strategic buyer deal count in May decreased 13% from April to the lowest count recorded in over a year. Strategic deal count fell 20% year-over-year.

![]() Following the broader deal count trends, sponsor activity increased moderately (13%) month-over-month but declined 5% year-over-year.

Following the broader deal count trends, sponsor activity increased moderately (13%) month-over-month but declined 5% year-over-year.

Active M&A Industries (U.S. Targets)

By Deal Count

By Deal Count

- The software industry remained at the top for U.S. M&A activity by deal count in May, continuing its streak as the leading industry by volume.

- Services industries remained active, with financial services and other professional services rounding out the top three sectors in May by deal count.

By Deal Value

By Deal Value

- The telecommunications carriers industry topped the charts by deal value, driven by the largest U.S. deal of the month, highlighted below.

- The software industry was pushed to second place for most active sectors by deal value in May, followed closely by the energy sector.

Monthly Blockbuster Deals

Largest U.S. Strategic Deal

Largest U.S. Strategic Deal

Cox and Charter Communications have agreed to combine in a transaction valued at $34.5 billion.

Largest U.S. Sponsor Deal

Largest U.S. Sponsor Deal

Blackstone agreed to acquire TXNM Energy in an all-cash transaction valued at $11.5 billion.

Inbound U.S. M&A Activity

Inbound U.S. M&A Activity

- By deal value, inbound U.S. activity plummeted 68% in May from April’s peak of nearly $50 billion. Year-over-year, inbound deal value dropped 49%.

- By deal count, acquisitions of U.S. targets by non-U.S. acquirers rose 13% in May. Year-over-year, inbound deal count declined 20%.

- UK and Canada-based acquirers tied for the largest number of inbound transactions in May, with 18 deals each. France trailed behind with 9 deals.

Outbound U.S. M&A Activity

Outbound U.S. M&A Activity

- By deal value, acquisitions of ex-U.S. targets by U.S. buyers in May climbed 53% from April, up 21% year-over-year.

- By deal count, outbound activity decreased moderately (-7%) from April to May. Year-over-year, outbound deal count declined 17%.

- U.S. acquirers predominantly looked to targets in the UK in May, with 36 transactions. Canada took second place with 17 transactions, while Australia and India tied for third with 9 deals each.

Market Spotlight: Germany

Market Spotlight: Germany

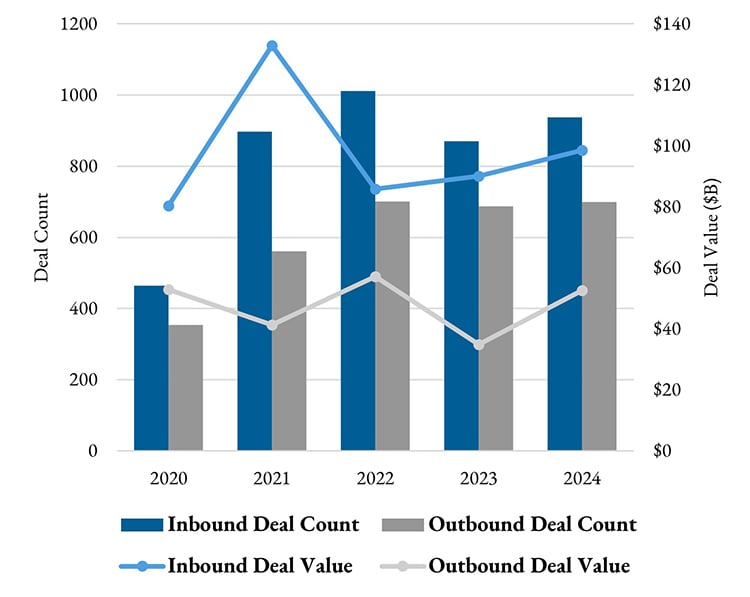

- Inbound Germany M&A activity was up in 2024 from 2023 but was less active than 2021–2022. Deal value in 2024 increased 10% to nearly $100 billion and deal count also increased, by 8%.

- YTD 2025, inbound deal value is up 27% from the comparable period in 2024, with announced transactions exceeding $25 billion, but is down 20% by deal count. The U.S. has been Germany’s largest inbound partner so far in 2025, followed by France and the Netherlands.

- 2024 outbound Germany M&A activity was up 51% from 2023 by deal value, to $50 billion. By deal count, inbound activity held steady (+2%) in 2024.

- YTD 2025 outbound activity has decreased significantly from the comparable period in 2024, with deal value down by 74% and deal count down by 25%. German acquirers have predominantly looked to targets in the U.S. in 2025, followed by the UK and Switzerland.

Delaware Court of Chancery Update: Enforcement of Releases

Delaware Court of Chancery Update: Enforcement of Releases

- In Jhaveri v. K1 Investment3, the Delaware Court of Chancery dismissed most of Ketan Jhaveri’s claims for breach of fiduciary duty, fraud, and aiding and abetting against various parties involved in Bodhala, Inc.’s 2021 merger with Onit, Inc.

- The ruling against Jhaveri was based on the fact that as a co-founder and a former significant stockholder of Bodhala he had signed broad release provisions in the merger agreement in exchange for millions of dollars in merger consideration.

-

Part of Jhaveri’s breach of contract claim and a related tortious interference claim was allowed to proceed, based on allegations that the Equityholders’ Representative failed to challenge Onit’s earnout calculations, and that certain Onit affiliates acted in bad faith by persuading the Equityholders’ Representative to not challenge the earnout calculations.

-

However, the court enforced the release and emphasized that Delaware law recognizes the validity of clear and unambiguous broad releases, provided that such releases are not obtained through fraud, duress, coercion, or mutual mistake (none of which were asserted by Jhaveri).

- Unless otherwise noted, charts compiled using Mergermarket data for May 2025 as of June 5, 2025. Aggregate deal values by dollar amount are calculated from the subset of deals with disclosed values.

- Medical industry classification principally includes medical devices/technology/services, excluding biotech and pharmaceutical deals.

- Jhaveri v. K1 Investment (June 27, 2025)

Stay Up To Date with Ropes & Gray

Ropes & Gray attorneys provide timely analysis on legal developments, court decisions and changes in legislation and regulations.

Stay in the loop with all things Ropes & Gray, and find out more about our people, culture, initiatives and everything that’s happening.

We regularly notify our clients and contacts of significant legal developments, news, webinars and teleconferences that affect their industries.