In Dealmaker’s Digest, read the top 10 latest developments in global transactions. We offer insights into M&A activity across industries and borders. To receive our M&A thought leadership, please join our mailing list.

Key Takeaways

- Global deal value is up YoY: Aggregate value is up 40% year-over-year, despite declines month-over-month across buyer types.

- Outbound deal value exploded YoY: Outbound deal value more than doubled year-over-year, yet inbound value was down by 9 percent.

- Regulatory delays remain post-shutdown: With possible SEC delays and the risk of future government shutdowns, dealmakers should adjust timelines.

- Hostile deal activity mixed: While hostile bids are up slightly from last year, the average size for the top 10 deals was far lower this year.

Global M&A Activity Update

Deal Value Trends

Deal Value Trends

- Aggregate global monthly deal value1 in November declined 17% from October’s peak of nearly $600 billion, halting a streak of record-breaking months. Despite the monthly drop, deal value was still up 40% year-over-year.

- The value of deals with strategic buyers decreased 11% in November from October’s surge but remained higher than the rolling six-month average by more than $30 billion. Strategic deal value was up 55% year-over-year.

- The reduction in value of deals with sponsor buyers led the downturn in November, dropping another 30% month-over-month. Despite the relative pullback, sponsor deal value was still up 15% year-over-year and was roughly on par with the 13-month rolling average.

Deal Count Trends

Deal Count Trends

- Global deal count in November remained roughly unchanged from October’s two-year low, increasing by only about 80 transactions overall (+4%). Year-over-year, deal count was down 21%.

- Strategic buyer deal count was also steady with October’s count (+5%). Year-over-year, strategic buyer deal count decreased 26%.

- While aggregate deal value of sponsor deals declined significantly (-30% month-over-month), deal count in November was stable month-over-month (+3%) and was only down 12% year-over-year.

Active M&A Industries (U.S. Targets)

By Deal Count

By Deal Count

- The software industry remained at the top for U.S. M&A activity by deal count in November, continuing its multi-year streak as the leading industry by volume, with a deal count nearly double the second most active industry.

- Services industries (financial and non-financial) also remained active, again rounding out the most active sectors in November by deal count, though closely followed by the industrials and construction sectors.

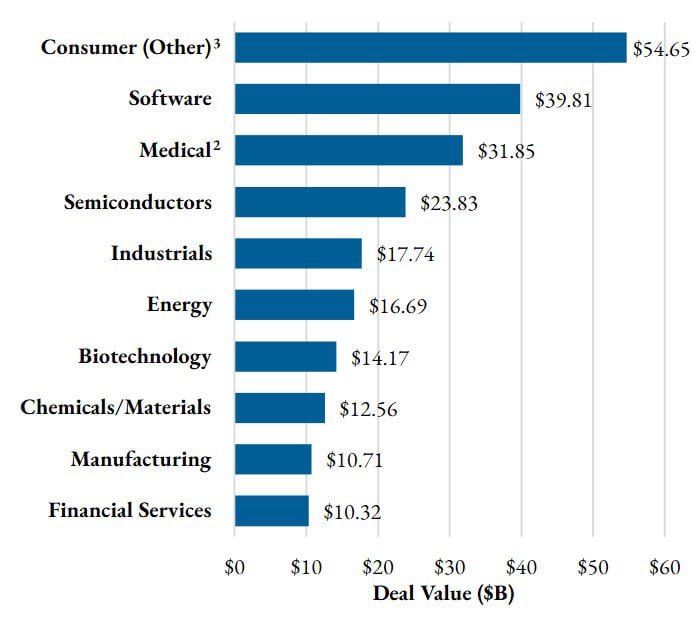

By Deal Value

By Deal Value

- The consumer (other) industry3 topped the charts by deal value in November, although nearly all of the sector’s monthly value driven by the Kenvue deal highlighted below.

- The software industry fell to second place with only one of the largest 10 deals.

- The medical industry2 followed in third place with several multi-billion-dollar deals.

Monthly Blockbuster Deals

![]()

Largest U.S. Strategic Deal

- Kimberly-Clark has agreed to acquire Kenvue in a cash and stock transaction valued at approximately $48.7 billion.

![]()

Largest U.S. Sponsor Deal

- Clayton, Dubilier & Rice has agreed to acquire Sealed Air in an all-cash transaction valued at approximately $10.3 billion.

Inbound U.S. M&A Activity

Inbound U.S. M&A Activity

- By deal value, inbound U.S. activity in November dropped another 46%. However, excluding September’s outlier surge (partially due to the large pending acquisition of Electronic Arts), November value was still above the 13-month rolling average of $28 billion. Year-over-year, inbound deal value was down 9%.

- By deal count, acquisitions of U.S. targets by non-U.S. acquirers in November were level with October’s count and just under the rolling 13-month average of 92 deals (excluding September). Year-over-year, inbound deal count was steady (-4%).

- UK-based acquirers undertook the largest number of inbound transactions in November with 15 deals, followed by Canada with 12 and Japan with nine.

Outbound U.S. M&A Activity

Outbound U.S. M&A Activity

- By deal value, acquisitions of ex-U.S. targets by U.S. buyers in November were down 9% from October to just under $50 billion. However, year-over-year, outbound deal value more than doubled (113%).

- Outbound deal count continued to decline in November, down another 6% to the lowest count recorded in over three years. Outbound deal count was down 22% year-over-year.

- U.S. acquirers predominantly looked to targets in Canada in November, with 24 transactions. The UK came in a close second place with 22 transactions, and Germany took third with nine deals.

TRANSACTION TREND: Unsolicited & Hostile Transactions Update4

TRANSACTION TREND: Unsolicited & Hostile Transactions Update4

- Heading into 2025, market conditions—including interest rate trends and shifting regulatory priorities—appear ripe for an uptick in unsolicited or hostile activity. In the first five weeks of the year, unfriendly deals made up over 30% of all bids.

- As market conditions cooled as the year progressed, 2025 hostile activity followed. Thirty-eight transactions were unfriendly this year, about 17.5% of total bids, with three turned hostile. That’s slightly up from 36 deals in 2024 (18.1% of total bids). However, excluding Paramount’s around $108 billion recent hostile bid for Warner Brothers, the average size of unfriendly deals for the top 10 deals was far lower in 2025 ($6.7B) than for 2024 ($18.3B).

- All in all, readiness planning by boards and advisors (e.g., defensive profile analyses and proactive shareholder and stockholder engagement) remains critical.

Post-Shutdown Impacts on Public Deals Process

Post-Shutdown Impacts on Public Deals Process

- During the government shutdown from October 1 to November 12, issuers filed over 900 registration statements with the SEC Division of Corporate Finance (“Corp Fin”). Corp Fin staff is working to clear the backlog of filings in the order in which they were received. It is, however, currently unclear whether Corp Fin staff will adhere to the usual 30-day initial review period while the backlog is being cleared.

- Filings submitted during shutdown without a delaying amendment retained their ability to go effective automatically after 20 days pursuant to Section 8(a). This is not without its risks as the liability and antifraud provisions of federal securities laws apply to all registration statements, including those that become effective by operation of law.

- Going forward, with government funding set to expire again in January 2026, it might be best for dealmakers to assume the potential for renewed risk of shutdown and to adjust timelines accordingly.

- Relatedly, EDGAR, the SEC’s electronic filing system, will be closed from December 24, 2025, through December 26, 2025; filings required to be made on those days will be considered timely if filed on December 29, 2025.

- Unless otherwise noted, charts compiled using Mergermarket data for November 2025 as of December 5, 2025. Aggregate deal values by dollar amount are calculated from the subset of deals with disclosed values.

- Medical industry classification principally includes medical devices/technology/services, excluding biotech and pharmaceutical deals.

- Consumer (Other) industry classification includes personal care, household products and all other consumer categories, excluding retail and food.

- Charts and 2025 data compiled using Deal Point Data metrics as of December 8, 2025.

For more information, please contact your usual Ropes & Gray attorney or reach out to a member of our M&A team below.

Stay Up To Date with Ropes & Gray

Subscribe to Our Podcast

Ropes & Gray attorneys provide timely analysis on legal developments, court decisions and changes in legislation and regulations.

Follow Us on Social

Stay in the loop with all things Ropes & Gray, and find out more about our people, culture, initiatives and everything that’s happening.

Join Our Mailing List

We regularly notify our clients and contacts of significant legal developments, news, webinars and teleconferences that affect their industries.